Tailored programs. Turnkey solutions.

Enhance your donor engagement

The numbers tell a compelling story. A growing number of donors seek to align their philanthropic investments with their values.

Our impact platform and suite of services enables you to deliver a differentiated value proposition. You can empower donors and their advisors to put philanthropic capital to work before it is granted.

Expand your reach

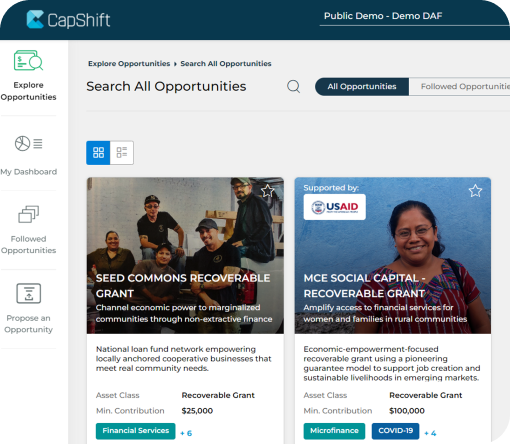

Easily find, diligence, and pre-approve specific investment options and recoverable grants that best align with your donors’ goals and giving priorities. Our proprietary database of over 1,600 public, private, and nonprofit impact opportunities covers a broad cross section of asset classes, impact themes, and geographies. Once you’ve built your menu, donors can then discover and recommend allocations to these offerings using your custom online portal.

View a demo of the platform.

Grow your program

Marketing support to help launch and promote your program. Thought leadership and impact reporting to inspire your donors’ recommendations. Market insights to keep your team and affiliated advisors abreast of industry and investment trends.

With our team as your partner, there are no one-size-fits-all solutions. We work to meet the specific needs of each DAF provider, while ensuring that all your existing donor and advisor relationships are respected.