Deep Dive: Unpacking Carbon Markets

What are Carbon Markets?

Carbon markets are similar to any other commodity market; they are an arena for the exchange of assets tied to the price of a specific commodity, in this case greenhouse gas emissions. Beginning in the late 1990s, carbon markets emerged with the goal of reducing carbon emissions by putting a price on the negative externality cost associated with emitting greenhouse gases. Since that time, carbon markets have evolved to the point that they now represent a growing investment opportunity for traditional and impact-oriented investors. At their core, carbon markets have one common goal: to use market dynamics to efficiently price the cost of emitting greenhouse gases and incentivize market participants to lower their carbon footprints.

Carbon Market Assets

There is one central type of carbon asset: a carbon credit. A single carbon credit is a tradeable token or certificate that is equal to the reduction, avoidance, or removal of 1 ton of carbon dioxide equivalent (CO2, Methane, Nitrous oxide, PFCs, HFCs or SF6). Any company or individual that holds a carbon credit can use it to either offset an amount of carbon dioxide equivalent to the amount that company or individual has emitted into the atmosphere. However, credits can only be used once, so whenever a credit is used it becomes a carbon offset and is no longer tradeable or usable. In recent years, the number organizations that issue carbon credits has proliferated, but in general, there are two main issuers that supply carbon credit assets:

1. Governments with regulatory carbon markets

2. Private entities that develop carbon offset projects

Demand for carbon credits comes from companies and individuals who can purchase carbon credits as permits to offset their greenhouse gas emissions and meet either mandatory or voluntary net emission goals.

The Two Types of Carbon Markets

Related to that last point, there are two main types of carbon markets: mandatory carbon markets, also known as “emission trading systems,” and voluntary carbon markets. These two carbon markets utilize the same asset in principle (carbon credits) but each market’s size, issuers, buyers, and trading systems differ greatly.

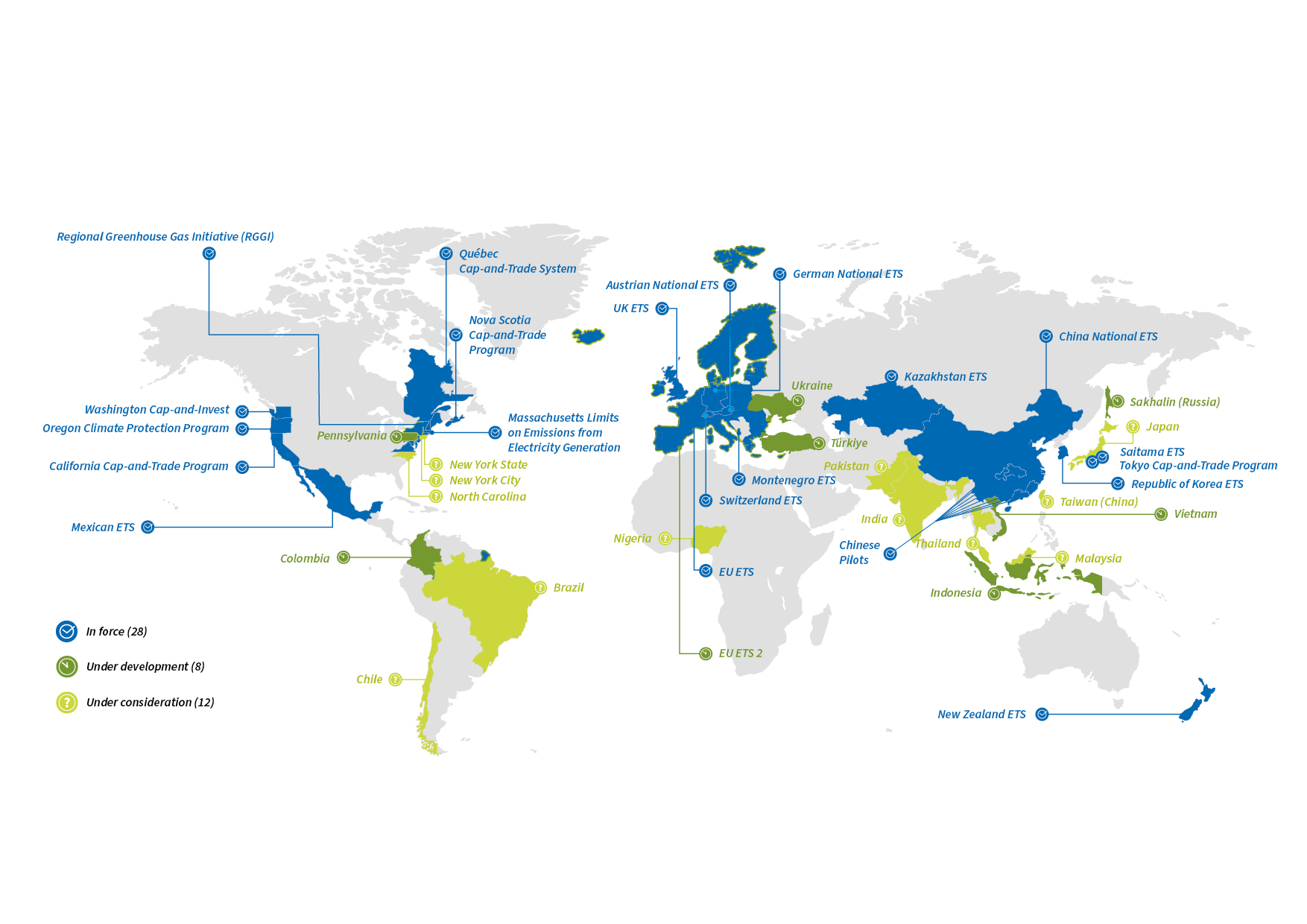

Mandatory carbon markets are run and administered by state or regional government authorities. These authorities establish caps on greenhouse gas emissions for specific industries which force companies operating in these industries to acquire carbon credits to offset any emissions above the established cap. Because of this, you may hear people call these markets, “cap-and-trade systems.” There are currently 28 cap-and-trade systems in-force worldwide, and in 2022 the value of these markets combined reached $909 billion in terms of traded credits.

There are currently 28 Active Emission Trading Systems in the World

Source: https://icapcarbonaction.com/system/files/2023-07/230315_Report_Infographics3_1.jpg

Companies operating in these cap-and-trade systems must purchase carbon credits that meet the standard of the administering governmental authority through government-led auctions or the burgeoning secondary market. Interestingly, auctions for these carbon credits are open to anyone who takes the time to register as a qualified purchaser with the relevant government authority, so over the last decade secondary markets have grown due to purchases of credits by exchanges, brokers, and investment managers. Additionally, one of the central tenants of cap-and-trade systems is that supply of government-approved credits is decreasing over time as governments set emission targets and auction off a decreasing number of credits year-over-year.This means that supply is theoretically decreasing while demand may remain constant or grow. This market dynamic creates unique upward price pressure on carbon credits in these markets and represents a potentially interesting investment opportunity for impact investors. From an impact perspective, more market participants in emission trading systems should further push the price of carbon credits upward and may indirectly lead to companies with mandatory carbon emission caps to reduce their overall footprints. Additionally, investors can retire credits without using them or selling them to companies for use, which leads to a direct reduction in the emissions.The second major carbon market is the Voluntary Carbon Market. Like those in cap-and-trade markets, market participants in the voluntary carbon market issue, sell, and buy carbon credits for the use of offsetting emissions. However, buyers in this market purchase credits not for regulatory reasons but rather because they proactively choose to offset their carbon footprints. These voluntary participants can include companies looking to improve their ESG profile or individuals looking to offset the carbon emissions of their own business activities or investment portfolios. Unlike in mandatory markets, carbon credits traded in voluntary markets do not have to be issued by governments but can be issued by private entities and verified by independent third-party carbon credit auditors (e.g. Verra, Gold Standard, etc.). For the most part, carbon credits issued, sold, and bought in this market are tied to projects that lead to the reduction, removal, or avoidance of carbon in the atmosphere. These could include renewable energy projects, carbon capture projects, afforestation or reforestation investment, and soil sequestration projects, among others. This fact has been the source of criticism in recent years, as there have been concerns raised about the credibility of voluntary carbon credits tied to various projects. For a voluntary carbon credit to be credible, it must be tied to a project that has definitively removed, reduced, or avoided greenhouse gas emissions. While independent private issuers do their best to establish methodologies to evaluate the validity of voluntary credits, they continue to suffer from a lack of transparency and mistrust in their own validation processes.

How can you invest?

How you choose to invest in carbon markets can differ depending on whether you decide to enter the mandatory or voluntary carbon market arena. Because of the transparency associated with government oversight, mandatory carbon markets have become a more liquid and easier place to invest. Each regional authority has their own exchanges on which to trade, and futures exchanges for mandatory credits have also begun to proliferate. This has led to several highly liquid Funds and ETFs to invest in related to mandatory emission trading systems. In 2022, there was $909 billion traded in mandatory carbon markets. Voluntary markets on the contrary have historically been less liquid and harder to access. In many cases, investors can indirectly invest in voluntary carbon credits by supporting projects that could lead to the issuance of credits in the future. In these cases, voluntary carbon credits could end up being a contributing factor to the returns of an investable project but may not be its sole purpose. Individual investors also have the option to buy voluntary carbon credits directly from private issuers, but in many cases it is hard for these investors to then sell them at an established market price. In recent years, there has been progress in making voluntary carbon credits more accessible to individual investors by creating a more robust secondary market through ETFs supported by futures contracts and other one-off exchanges, but without the same transparency and regulation as mandatory carbon markets, these products are often open to credibility questions.