2023 CapShift Impact Report

In the past year, CapShift’s clients have:1

Shifted $142 million

into impact-driven funds and enterprises

Funded 60+

public, private, and nonprofit impact funds and enterprises working to tackle entrenched problems through our network

For CapShift clients this past year marks a profound shift—a change from responding to emergencies to proactively crafting impactful programs that are incorporated across teams and available to a larger number of families.

The result: this year our clients have moved nearly as much money for impact as they had cumulatively over our history.

The top five impact themes supported by CapShift’s clients included:2

38%

Food and Agriculture

23%

Climate Solutions

12%

Financial Services

11%

Housing

6%

Healthcare

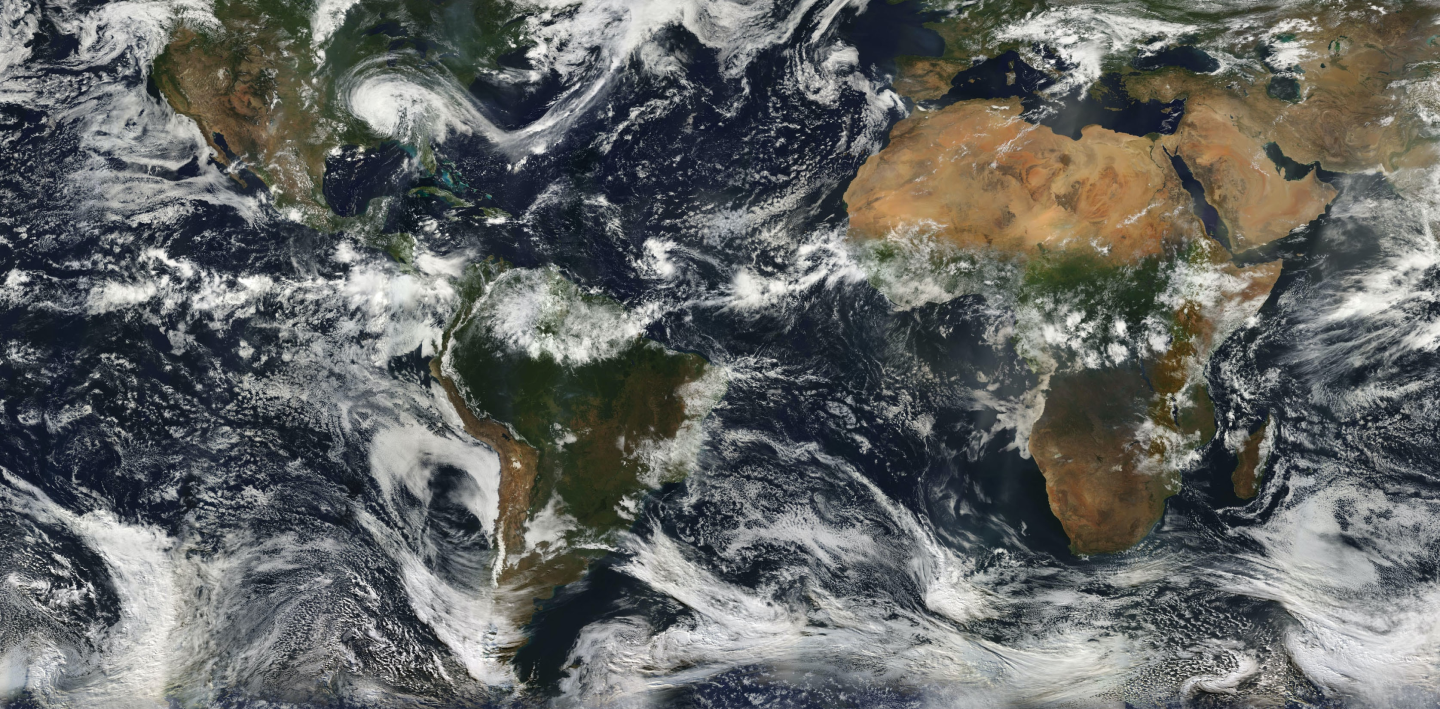

Geographies supported by private investments and recoverable grant allocations

- 54% flowed to funds and organizations supporting communities across the U.S.

- 46% flowed to funds and organizations working globally3

Organizations addressing 16 of 17 of the United Nations Sustainable Development Goals received funding:4

Within each of these numbers are hundreds of stories of impact. Here are just a few.

Endnotes

1: Source: CapShift internal data from July 1, 2022 to June 30, 2023.

2: Source: CapShift Impact sector data represents the amount of money moved directly into impact focused private and recoverable grant opportunities from July 1, 2022 to June 30, 2023. Impact sectors and geography as assigned by CapShift. Excludes all public investments, private investments and recoverable grants supported indirectly. Excludes opportunities with multiple underlying sectors (e.g., multi-impact sector funds). Self-reported or CapShift ascribed classification refers to primary impact sector only and opportunities may operate across multiple impact sectors. Excludes all public investments, private investments supported indirectly.

3: Source: CapShift. Geography as assigned by CapShift based on information shared by issuers in public-facing material or during due diligence. Excludes all public investments, private investments and recoverable grants supported indirectly.

4: Source: CapShift. UN SDG data: Each opportunity corresponds to its top 3 SDGs either self-reported or CapShift ascribed based on review and comparable opportunities. Excludes all public investments, private investments supported indirectly.

6: Equivalency from the EPA Greenhouse Gas Equivalencies Calculator.

7: Source: CapShift internal data.

Disclosures

This report highlights the self-reported impact of CapShift LLC and CapShift Advisors, the two entities are referred to as CapShift throughout the report. CapShift gathered self-reported data from a select group of funds, nonprofits and social enterprises that received investment or grant capital directly or indirectly from work CapShift performed or influenced. The data CapShift is reporting has not been audited or reviewed by a third-party.

This report does not constitute an offer to sell or a solicitation of an offer to purchase any security. Any such offer or solicitation would only be made pursuant to an offering memorandum or prospectus. All investments entail a high degree of risk and no assurance can be given that the investment objective will be achieved or that investors will receive a return of their capital. Any investment opportunities highlighted in this report are presented for illustrative purposes only. Opportunities may not be suitable for all investors due to differences in risk tolerance, investor status, and investment time horizons, amongst other factors. Additionally, investments may not achieve stated social, environmental, or similar objectives.