An Advisor’s No-nonsense Guide to Impact Investing

We’ve collected some of the most commonly asked questions to help you deliver impact investing solutions to your clients.

The Essentials

What is impact investing?

Impact investing is an investment made with the intent to generate measurable, beneficial social or environmental impact alongside financial return.

Return expectations are an important element that distinguishes impact investing from philanthropy. Impact funds and enterprises have a mechanism for generating revenue, with the goal of returning capital — and then some — to investors.

Did you find this answer helpful?

Why should an advisor care about impact investing?

Advisors that we work with tell us they are surprised at how quickly client demand for impact investing has grown. Indeed, 45% of all high net-worth (HNW) investors say they own or are interested in making impact investments. Impact investing can be a notable differentiator or entry point in establishing a relationship with HNW prospective clients.

In addition, given the personal nature of impact investing, we also hear that it helps cultivate a more personal connection with existing clients and maintain stickier relationships.

One trend worth keeping an eye on is how younger investors are significantly outpacing their counterparts in impact investing interest and participation. Millennials are nearly three times more likely to be actively involved in impact investing than their Baby Boomer counterparts. And nearly all Millennials (92%) have a positive impression of impact investing (compared to just over half of Baby Boomers). As wealth transitions over the next decade, advisors will likely see a notable uptick in impact investing demand. 59% of Next Gen wealth inheritors say it’s vital that their advisor understands their values and customizes a portfolio centered around their impact.

Did you find this answer helpful?

How do impact investments perform?

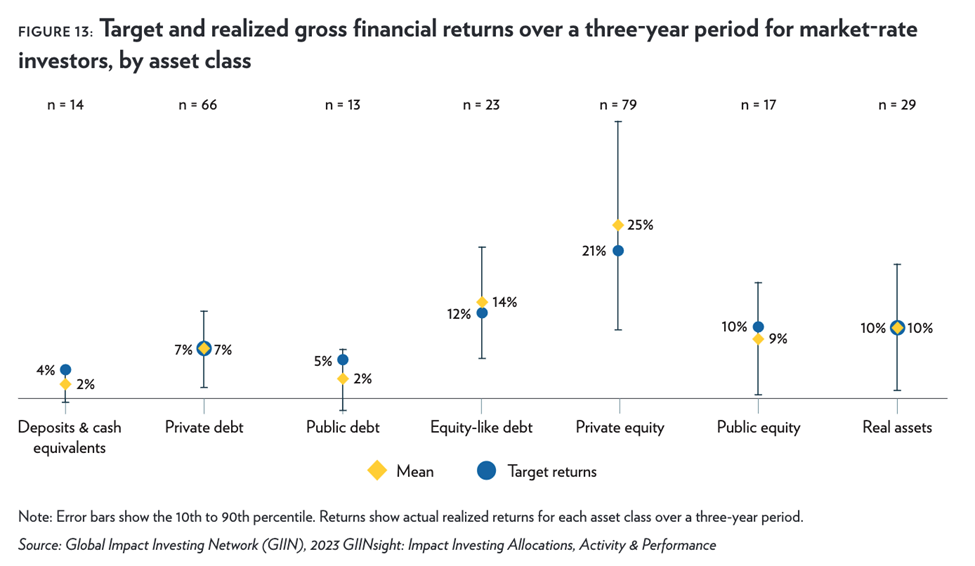

Recent market research shows that funds targeting risk-adjusted, market-rate returns have largely met expectations across asset classes.

Some impact investments may intentionally prioritize impact over risk-adjusted, market-rate returns. We categorize these opportunities as “impact-first” investments.

Both are prevalent in the impact investing landscape. About two-thirds of the opportunities featured in CapShift’s Research Engine is comprised of market-rate investments; a third is “impact-first” investments. (As of January 2024).

Did you find this answer helpful?

What investment products are included in "impact investing", and what investment products are not?

Impact investments are available across asset classes, sectors, and geographies. These investments span funds from institutional managers to direct investments into young businesses.

In terms of what qualifies, you can think of “impact investing” as comprised of “impact” and “investing” (a no-brainer, we know).

When it comes to “impact,” intent (i.e. a social or environmental mission) and measurable outcomes are the two boxes an impact investment must check. On the other hand, as investments, these opportunities should target the repayment of capital — at minimum — and additional returns to investors. This sets impact investments apart from charitable activity, which has no expectation of investment returns.

Did you find this answer helpful?

Is impact investing the same thing as ESG?

ESG (Environmental, Social, Governance) is a risk mitigation approach employed in public equities investing that considers the material risks related to “E,” “S,” and “G” factors in security selection and portfolio construction. Take, for example, a fund that omits fossil fuel exposure given the risks and market transformations presented by climate change.

Most ESG funds do not, in our opinion, qualify as impact investments given the latter’s criteria of established intent and measurable impact.

However — in an analysis of over 300+ funds — we found that a small group meets the bar for authentic impact in public markets. Generally, they incorporate at least one of these four strategies: shareholder advocacy and active engagement, investment in solutions-oriented companies, measurement and reporting of specific impact outcomes, and deep or unique ESG integration.

Did you find this answer helpful?

No time to read?

Listen to the experts on our podcast, Capsule.

What It Means for your Advisory Practice

How much demand is there for impact investing?

79% of all investors are interested in sustainable and impact investing, according to Morgan Stanley; yet, less than a third of investors have been approached by their advisor on impact investing. Particularly worth noting, 45% of all high net-worth (HNW) investors say they own or are interested in making impact investments.

Doubling in size between 2019 and 2022, the impact investing market is estimated to be about $1.2 trillion as of 2022, according to a report published by the Global Impact Investing Network.

Also worth keeping an eye on is how younger investors are significantly outpacing their counterparts in impact investing interest and participation. Millennials are nearly three times more likely to be active in impact investing than their Baby Boomer counterparts. And nearly all Millennials (92%) have a positive impression of impact investing (compared to just over half of Baby Boomers).

Did you find this answer helpful?

If a client hasn’t made a request why does impact investing matter?

We notice that impact investing overlaps with three broader market trends relevant to advisors, particularly as they relate to high net-worth individuals.

- Client interest in private markets has increased dramatically, nearly tripling to $12 trillion over the past decade. A key driver is the increase in HNW investors and family offices investing in alternative assets. It might not be a surprise, then, that 45% of high net-worth (HNW) investors say they own or are interested in making impact investments.

- We’re also observing a groundswell of interest and capital allocation in the climate sector. In fact, climate technology companies — alongside AI — took the majority of top venture deals in Q4 2023.

- Younger investors are significantly outpacing their counterparts in impact investing interest and participation. Millennials are nearly three times more likely to be actively involved in impact investing than their Baby Boomer counterparts. And nearly all Millennials (92%) have a positive impression of impact investing (compared to just over half of Baby Boomers). As wealth transitions over the next decade, advisors will likely see a notable uptick in impact investing demand.

Did you find this answer helpful?

How are impact investing capabilities and conversations driving client retention?

96.5% of high net-worth heirs fire their parent’s financial advisors, with a fifth of them saying those advisors were “out of touch.” Over the next two decades a total $72 trillion is expected to transfer to the next generation, with more than half ($35 trillion) expected from ultra-high and high net-worth households.

Younger investors are significantly outpacing their counterparts in impact investing interest and participation. Millennials are nearly three times more likely to be actively involved in impact investing than their Baby Boomer counterparts. And nearly all Millennials (92%) have a positive impression of impact investing (compared to just over half of Baby Boomers).

As wealth transitions over the next decade, advisors will likely see a notable uptick in impact investing demand. Indeed, 59% of Next Gen inheritors say it’s vital that their advisor understands their values and customizes a portfolio centered around their impact.

Did you find this answer helpful?

What clients might be interested in impact investments?

Below are three types of clients that may be most suitable for introducing impact investments — and characteristics to look for.

Community and philanthropically oriented clients

- Has a donor advised fund (DAF) or family foundation

- Is active in their local or faith-based community

- Speaks to you about year-end giving

- Skeptical of or disillusioned with traditional philanthropic vehicles

- Care about the world they are leaving behind for the next generation

- Serves as a board member of a local nonprofit

Clients with thematic interests

- Concerned about the effects of the climate crisis

- Has ties to or is passionate about the education system

- Invested in providing opportunities to historically marginalized groups

- Interested in technology/AI/innovation for global challenges

- Has a family member suffering from a specific medical condition

- Eager to support humanitarian crises

Lifestyle

- Conscious about products that align with their values

- Prioritizes a healthy, sustainable diet or lifestyle

- Enjoys outdoor recreation and spending time in nature

- Appreciates different cultures or enjoys travel

- Has ties to or deep roots in a certain community, city, or geographic region

Did you find this answer helpful?

How might impact investing grow your practice?

Impact investing helps advisors attract new clients and retain existing relationships — particularly high net-worth and Next Gen ones.

45% of all high net-worth (HNW) investors say they own or are interested in making impact investments. Impact investing can be a notable differentiator or entry point in establishing a relationship with HNW prospective clients. Younger investors are also significantly more involved and interested in impact investing; for example, nearly all Millennials (92%) have a positive impression of impact investing.

Impact investing also gives advisors the opportunity to show up for clients in areas that are deeply personal to them, maintaining stickier relationships. Indeed, 98% of current impact investors plan to maintain or increase the amount allocated; and nearly two thirds (62%) are very satisfied with their participation.

Did you find this answer helpful?

Nuts and Bolts

What asset classes make up impact investing? What does impact look like in each asset class?

You can find impact investments across every asset class, from public equities to venture capital to private debt. Here are some examples:

- Venture Capital: A venture capital fund invests in companies that have the potential for gigaton-scale climate impact.

- Private Equity: Growth equity and buyout fund focuses on scaling education and workforce development companies targeting underserved communities

- Private Credit: A debt fund extends low-interest loans to newly arrived refugee and asylee families to help them build credit in the U.S.

- Public Equity: Diversified strategy focuses on engaging with holding companies on sustainability, workplace development, and diversity and inclusion.

- Real Assets: A timberland fund that implements sustainable harvesting strategies and monetizes conservation easements.

- Direct Investment: A startup develops technology to more efficiently produce lithium, a key ingredient to batteries critical to supporting a transition to a lower carbon economy.

Did you find this answer helpful?

Is there a minimum amount of capital required to begin impact investing?

Impact investing in cash and public markets can be done at very low minimums, just like tradition depository accounts and public equity funds.

Some private fixed-income products have minimums that start at as low as $20. And Community Development Financial Institutions (CDFIs) — a way to invest in local communities — offer notes that can be accessed at a thousand dollars or less.

Other private-market impact investments, such as in venture capital or private equity funds, tend to have investment minimums at two-hundred and fifty thousand or higher.

Did you find this answer helpful?

What's an example of a successful impact investment?

The first Elevar Equity Fund is a good example of a successful and fully matured impact investment fund.

Elevar Equity invests growth capital specifically in entrepreneurs that tackle the intersection of inclusivity, affordability, and scalability. Its first fund, vintage 2006, invested in seven budding institutions targeting financial access for historically marginalized communities — helping them grow into high-capacity, regulated finance companies.

The fund returned 44% IRR to investors; Elevar supported companies have reached more than 20+ million end-customers to date through its portfolio focused on financial access, affordable housing, education, and more.

Did you find this answer helpful?

What is impact measurement, management, and reporting? How do I use this in practice?

In one sentence — impact measurement and reporting measure and communicate the social and environmental outcomes of an investment.

This exercise of measurement and reporting builds trust by offering evidence that their intended benefits are being realized. Importantly, it can deepen satisfaction and interest in a clients’ purpose-driven investment.

For example, a green infrastructure fund might measure its portfolio companies’ total emissions averted, energy produced renewably, and jobs created. Its impact report might share its approach, framework for measurement, and metrics collected.

In fact, over three-fourths of investors who make impact investments report that their investment’s impact (88%) and financial (79%) expectations are being met or exceeded. Impact reporting is often used as an engagement tool to spotlight the successes of the investment.

Did you find this answer helpful?

What’s an easy way to understand the landscape of impact themes?

The impact landscape can seem overwhelming — with opportunities stretching from sustainable aquaculture to education technologies.

But there’s a simple, broadly recognized framework for identifying categories of impact investments: The United Nations Sustainable Development Goals (UN SDGs). The 17 goals, adopted by all U.N. member states in 2015, is a shared blueprint for progress towards a more sustainable and prosperous global future.

Impact investments often self-identify which goal(s) they contribute to; and this framework is a great starting point to identify your client’s impact goals.

Did you find this answer helpful?

What’s the difference between ESG, SRI, and CSR?

ESG (Environmental, Social, Governance) is a risk management framework employed in public equities investing that considers the material risks related to “E,” “S,” and “G” factors in security selection and portfolio construction.

SRI (Socially Responsible Investing) is an investment philosophy that takes into account ethical considerations. Many SRI strategies incorporate screens to filter out holdings commonly associated with addictive substances, weapons production, environmental harms, etc.

CSR (Corporate Social Responsibility) is a business approach whereby companies see their role as contributing to the well-being of planet and people, in tandem with their economic interests.

Did you find this answer helpful?

Client Interest Themes

What are the most popular themes in impact investing?

Some of the most common areas of interest our clients cite include:

- Climate: Pioneer new technologies to mitigate carbon emissions and help communities adapt to the effects of the climate crisis.

- Equity & Inclusion: Promote fair systems and equal opportunities, particularly for overlooked groups.

- Healthcare: Enhance health outcomes through breakthrough innovations and ensure equitable access to services for everyone.

- Local Investing: Build up small businesses and local economies that serve as the foundation of thriving communities.

- Sustainable Agriculture: Support farmers and agricultural innovations advancing soil health, regenerative systems, and food security.

Did you find this answer helpful?

How could a client get started if they’re interested in investing locally?

Many clients interested in supporting their community start with an allocation to a community development financial institution (CDFI).

CDFIs can be banks, loan funds, or private equity funds that support local small businesses, development of affordable housing, and other community facilities and services. Most are anchored in place, knowing the communities they serve intimately. These organizations have a long track record of adding value to the communities they serve.

CDFIs tend to be a popular choice for first-time impact investors because of their accessibility (with investment minimums of $1,000–$10,000), easy-to-understand products like notes and FDIC-backed depository accounts, and variety in focus areas.

Did you find this answer helpful?

What are the ways I can help a client passionate about racial equity and justice integrate this goal into their portfolio?

CapShift’s Racial Justice Framework — developed with the help of TheCaseMade — identifies three categories of equity-focused investments:

- Diversity and Inclusion: Investment opportunity intentionally seeking or supporting diversity and inclusion in employees, ownership, customers, and beneficiaries.Example: A private equity firm focused on addressing training gaps in healthcare and technology, with an initiative focusing on employees of traditionally overlooked backgrounds.

- Racial Equity: Opportunities creating pathways for BIPOC (Black, Indigenous, and People of Color) communities to thrive. They support longer-term outcomes tha level the playing field.Example: A loan fund providing BIPOC-owned small businesses in the South with flexible, low-cost funding.

- Racial Justice: Investments driving systemic change — a necessary precondition for true racial justice — reshaping the pattern of historical underinvestment in BIPOC communities.Example: A cooperative that gives historically marginalized communities control over how to invest non-extractive funding.

For more information, consult our primer on racial equity and justice.

Did you find this answer helpful?

What are the common climate investing approaches a client might adopt?

Based on feedback from dozens of families, we found that three commonly pursued goals for climate investing are mitigation, resiliency, and alpha:

- Mitigation: Reduce, prevent, or remove heat-trapping greenhouse gas emissions in the atmosphere, addressing the root cause of warming. Examples include renewable energy, electric vehicles, and biofuels.

- Resiliency: Help vulnerable communities and economic systems adapt to the impacts of climate change, reducing potential risks and damage. Examples include sustainable small-scale agriculture, smart electric grids, and flood-resistant water infrastructure.

- Alpha: Boost investment returns and reduce volatility by mitigating climate-related risks and investing in climate opportunities. Examples include fossil-fuel-free private portfolios, electric vehicle infrastructure, and carbon credit generation.

For more information, consult our primer on climate investing.

Did you find this answer helpful?

Trending Topics

What should I make of the recent ESG critiques?

Over the last two years, use of ESG (Environmental, Social, Governance) data by fund managers has become a hot-button issue in the U.S. political sphere, with stances largely split across party lines.

While it has become a politicized lightning rod, we view ESG as a relevant risk management framework employed in a market environment increasingly influenced by the climate crisis and public scrutiny towards corporations.

But we also agree that not all ESG products are cut from the same cloth; the ESG landscape is broad, and we see many asset managers charge higher fees for minimal ESG integration. Investors have grown weary of these types of disingenuous products, as evidenced by the $2.1 billion in outflows in the third quarter from iShares ESG Aware MSCI USA ETF, which only uses basic ESG screening to build its portfolio.

We think this is a good thing — investor scrutiny, as well as increased regulatory oversight deepens the rigor of ESG frameworks.

Of course, the quality of the strategy and its integration makes all the difference. In our analysis at CapShift, we evaluate the authenticity of the strategy — including its thesis, voting, shareholder advocacy, and more — as well as fees and fund performance indicators.

Our outlook is that — despite loud anti-ESG campaigns — sustainable funds will continue to be attractive to investors because they capture important macroeconomic trends like decarbonization, energy transition, workforce transformation, and proper governance.

Did you find this answer helpful?

What is impact- and green-washing? Should I be worried about it?

Impact-washing and green-washing are when organizations or funds overstate or falsely claim an investment’s positive impact on the environment or society. It can be done intentionally to attract investor capital or may occur unintentionally due to inadequate resources and expertise.

Impact- and green-washing can erode client confidence, underscoring the importance of thoughtful sourcing and diligence, as well as measurement and reporting.

As an advisor, you can combat impact- and greenwashing in the following ways:

- Assess impact strategy and transparency in sourcing and diligence. Before the investment is made, advisors can evaluate the depth and rigor of impact integration by reviewing the theory of change, specific investment policies or strategies, and previous or expected reporting.

- Identify the organization’s metrics and reporting. Advisors can also explore the metrics the organization plans to report on (or already has). Do they make sense in relation to the strategy? Are there common industry frameworks — like the IRIS+ framework — integrated or third-party verification services used?

- Evaluate outcomes by comparing against promises. Continued monitoring after the investment is also important. Advisors can review progress against key milestones, as well as examine changes in key impact metrics.

Did you find this answer helpful?

Is impact investing more relevant for clients with philanthropic capital?

There are over a trillion dollars of charitable assets in the U.S., much of which is allocated to investments before being granted out.

Only a small fraction of those assets are invested in impact. This means that at best, they are impact-neutral; in some cases, they may fund companies that directly conflict with the mission of the charitable capital. One example is a client who is interested in climate causes who may be unknowingly exposed to fossil fuel companies actively fighting against their climate efforts.

Impact investing allows clients to affect change over the lifetime of the capital, not just at the moment it’s granted out.

Many high net-worth individuals choose to align their investments to their philanthropic goals with their foundation or donor advised fund (DAF) assets. DAFs are giving accounts sponsored by community foundations, financial institutions, or specialized charitable organizations.

Did you find this answer helpful?

How might my client’s political opinions impact their reception to impact investing?

You might be surprised that political lean does not have a significant effect on impact investing interest. Morgan Stanley’s report surveying 1,000 investors found that 82% of very conservative investors, 84% of moderate investors, and 94% of very liberal investors reported being very or somewhat interested in impact investing.

CapShift empowers advisors who work with us to deliver impact investing to their clients — every step from navigating client conversations to investment diligence. Get started with us.

Did you find this answer helpful?

Recoverable Grants

What is a recoverable grant?

Recoverable grants are a form of charitable giving that provides nonprofit organizations with risk tolerant capital with the potential to return dollars back to your client’s charitable accounts. This tool gives the nonprofit the flexibility of a grant, while preserving the opportunity for the funds to be returned back to your clients’ charitable accounts if the program accomplishes its financial and impact objectives. Clients can use recoverable grants to support catalytic, innovative projects, expand revenue-generating solutions, or bridge funding gaps – and if successful, used again for additional grantmaking. This type of flexible capital is critical to helping nonprofits scale their impact, allowing them to take risks to bring new solutions to entrenched problems.

Did you find this answer helpful?

Why should advisors care about discussing philanthropy, and specifically recoverable grants with clients?

By integrating philanthropy into a client’s financial picture, advisors can be a part of helping clients make a lasting, positive impact on the world. Philanthropy presents a unique opportunity for advisors to build stickier client relationships by helping clients align their financial plans with their values, while also offering tax benefits and legacy planning opportunities.

Philanthropy is often an area where clients are deeply involved, whether or not their advisor is engaging in it with them. Recoverable grants are also a unique and exciting way for clients to support more niche, high impact structures that may not otherwise be suitable for their investment portfolios.

Recoverable grants are a great tool for clients looking to make an impact through their donor advised fund (DAF), while preserving their longer-term asset base. Leveraging recoverable grants can be a way to make an initial upfront commitment that can be used again and again as funds are returned from successful projects. The minimum recoverable grant size across most DAF providers starts at just $25,000, so this philanthropic tool can be an accessible way for clients to get started, either by supporting organizations in their network or discovering new nonprofits to them with an aligned mission.

Did you find this answer helpful?

For which clients would recoverable grants be suitable?

Recoverable grants can be suitable for many different types of client needs.

Those interested in catalytic capital: Most often, recoverable grants may be a good fit if clients have shown interest in catalytic capital, program related investments, impact-first investments, charitable investments, or venture philanthropy.

Those who are new to grantmaking: Recoverable grants can also be a great tool for families with a donor-advised fund or a foundation that have not yet been active in their grantmaking to explore impact areas and organizations that might be right for them while planning for longevity.

Those who are frustrated with traditional philanthropy: Individuals who are disillusioned with traditional philanthropy may also be interested in recoverable grants as a way to have an impact through supporting sustainable revenue streams.

Those who sit on a nonprofit board: Nonprofit board members are commonly interested in leveraging recoverable grants to support the mission of the nonprofit by helping them lower their cost of capital or seeding new programs.

Did you find this answer helpful?

How are recoverable grants different from program related investments or other impact investments?

Recoverable grants and investments differ in their primary intent and expected outcomes. Recoverable grants are a type of charitable giving with the primary intent to maximize impact, and if the nonprofit receiving the recoverable grant is successful, some or all of the capital may be returned to the donor for future grantmaking. If the program does not meet the stated impact and financial goals, or the project timeline takes longer than expected, the nonprofit is not required to return the funds, and it is converted to a traditional grant. Impact investments and loans are intended to generate returns alongside impact, with clear expectation for return.

Did you find this answer helpful?

What's an example of a successful recoverable grant?

We most commonly see three funding scenarios that are well aligned for successful recoverable grants.

- Help bridge a funding gap

Funding gaps occur during the lag in timing between when a nonprofit needs to provide goods or services or kick off a major expense, and when donations or funders arrive. For example – if a nonprofit is called upon to provide support during a natural disaster, humanitarian crisis, or war – the organization can use recoverable grant dollars to provide support when crisis hits. As donations from other sources arrive, the nonprofit can return the capital to the recoverable grant maker.

- Help scale a revenue-generating program quickly

To respond to new and rising needs, nonprofits may need help scaling a program quickly. For example, if a nonprofit has built an affordable housing complex with co-located social services in one city and is looking to scale that model to other cities, recoverable grants are one way for donors to support this expansion. The recoverable grant capital can be used to purchase a building, build out the necessary infrastructure of services, and staff the complex. Once the project is up and running and the nonprofit is collecting revenue, the organization can use that revenue to return the funds.

- Help innovate and take bold risks

Early-stage companies often need to secure highly risk-tolerant seed or angel funding to build and test innovative solutions. Recoverable grant capital can serve the same purpose for a nonprofit organization. For example, if a nonprofit is working to test a new, unproven solution to address climate change, they need patient risk capital to help fund catalytic innovations that have the potential to transform climate change realities. If the organization fails, then the recoverable grant money converts to a traditional grant, and if they succeed, some or all the funds could be returned.

Did you find this answer helpful?

What types of nonprofits offer recoverable grants?

Recoverable grants can be used to support nonprofits in many different issue areas, including affordable housing, health, climate mitigation and resilience, global development, financial inclusion, humanitarian aid, education, and local, placed based investing.

Did you find this answer helpful?

How much of this grant capital should clients hope to come back?

Unlike traditional grants which can be thought of as ‘total capital loss,’ recoverable grants offer the potential for up to 100% of funds to come back, and sometimes more. However, it’s important for clients to know that sometimes recoverable grants are not returned to donors.

Recoverable grants can be used for anything from short term bridge capital, which tends to be shorter in term length and have a higher probability of recovery, to making big bets that may involve increased risk that capital is not recovered.

Did you find this answer helpful?

How can my clients make recoverable grants?

Clients can make recoverable grants from both donor advised funds (DAF) and private foundations. While the eligibility criteria vary, most providers have a minimum recoverable grant size of $25K with a DAF account size requirement of $500K+.

Did you find this answer helpful?

Navigating Client Conversations (Premium)

How do you know if a client is ready for impact investing?

Below are three client types that are primed forimpact investing:

- They’re philanthropically minded. If your client has charitable capital, does any kind of granting, or talks about purpose and legacy; chances are that impact investing — as a way to further their mission — would excite them.

- They plan with future generations in mind — or their input. Another group receptive to impact investing is those who are estate-planning for future generations. Many will fold the younger generation into the process to begin an intergenerational conversation around wealth and purpose.

- They’re actively involved in a cause. These clients might sit on a nonprofit board or approach you about interesting investments in a certain theme. They’re already deeply invested in an impact area, and are often looking for additional ways to make a difference.

Did you find this answer helpful?

What questions might I ask a client to assess their interest in impact?

To determine if impact investing is right for your client, you can broach the topic with the following questions

- What are the issue areas or causes you care about the most?

Listen for: Thematic areas, places, or values. - What are you hoping to achieve? And when?

Listen for: Philanthropic objectives, financial goals, time horizon - What do you want your legacy to be? Prompt them around financial and more broader legacy goals.

Listen for: Estate planning, wealth transfer, intergenerational impact goals

Did you find this answer helpful?

How can I better understand my clients' views on impact investing?

To understand a client’s views towards impact investing, we recommend gathering information about their values, definition of impact investing, and approach.

Asking about a client’s values is an easy way to kick off the conversation. You might ask if there are specific causes they care deeply about, any giving priorities they have, or if they are involved in any nonprofits.

We’ve found that it’s also important to understand your client’s definition of impact investing. You might ask if they’re familiar with the concept or what they know about it. For example, some clients may equate ESG and impact investing — and be unaware of the rich opportunities in private markets.

Aligning on a shared definition of impact investing paves the way for the final piece: your client’s approach. How do they see impact investing fitting into their overall strategy? Is it an additional way to support the philanthropic cause they care about? A do-no-harm investment approach while maintaining liquidity for grant giving? A new way to support their favorite nonprofit?

With this context, advisors are better equipped to meet their clients’ impact needs.

Did you find this answer helpful?

What are the most common impact themes in demand from clients?

The top areas of client demand we have seen across our practice include:

- Food and Agriculture: Support a healthy food and agriculture industry through sustainable farming practices, reduced food waste, and sustainably managed farmland.

- Climate Solutions: Address the climate crisis through energy, conservation, and carbon solutions.

- Financial Services: Expand access for individuals and small businesses to affordable, fair, and useful financial services.

- Housing: Provide affordable housing and pathways to homeownership for individuals and communities in need.

- Health: Fund inclusive and quality health services, medicines, and technologies with the goal of improving health and well-being for all.

- Equity and Justice: Drive systematic change to address the socio-economic gaps experienced by historically marginalized groups.

Did you find this answer helpful?

What questions should I add to my client profile to help with integrating impact into their investment strategy?

These questions can give you an idea of their interests, goals, and return orientation.

- What are the issues or causes where you seek to have an impact?

- What would success look like?

- Are you interested in taking on a higher risk profile or lower nominal return to achieve outsized impact goals?

Did you find this answer helpful?

Meeting Client Needs (Premium)

How do advisors typically meet their clients' requests for aligning their investments with their values?

Advisors can meet clients where they are at in their impact investing journey.

For first-time impact investors, advisors can adopt a “toe-dipping” approach, recommending one investment that aligns with their client’s interest area. This gives the client an opportunity to see how it performs and decide if they want to go bigger.

If your client wants to make a bigger splash, you can recommend a carve-out. This means taking a portion of their capital and aligning it with impact.

Passionate or sophisticated impact investors may aim for the full alignment of their portfolio. In this case, an advisor will typically overlay their client’s impact goals across the portfolio’s asset allocation strategy. This allows an advisor to best identify products that meet the portfolio’s financial and impact goals. For example, a CDFI note might be suitable for a client interested in local investing whose portfolio is missing a cash-equivalent or liquid fixed-income option.

Did you find this answer helpful?

How do you add impact investments into a portfolio?

Like adding any investment to a client’s portfolio, the first step involves understanding your client’s goals and risk tolerance. With impact investing, there’s an additional step: understanding a client’s impact goals. These may relate to an interest area (like climate or affordable housing), place (like their hometown or community they identify with) or specific approaches (e.g. funding moonshot climate ventures, investing in systematic change, or meeting immediate housing needs).

Based on those preferences, advisors may further narrow down the universe of opportunities based on the portfolio’s allocation strategy and overall risk management approach.

Then comes the tricky part: sourcing and diligence. Given the industry expertise required to navigate the impact investing market, advisors often rely on tools like impact investing databases and other consultants or specialized advisors to lend a hand in discovering opportunities and diligencing them.

Finally, most impact investments follow an allocation and monitoring process similar to a typical investment.

Did you find this answer helpful?

How can impact investing be efficiently deployed while meeting often-custom demand from clients?

Firms can stay ahead of the curve by developing a set of opportunities that satisfy the most common impact areas of interest and are easily integrated into client portfolios from a risk and liquidity standpoint. We find that a set of 3-5 cross-sector opportunities can satisfy most key interest areas.

For larger clients with interest in specific products or niche interests (think circular economy, mental health solutions, or smart cities), many advisors lean on impact investing databases or specialists to discover unique opportunities.

Did you find this answer helpful?

My client has a private foundation, are there unique considerations around impact investments?

There are two ways to make an impact investment from a foundation:

Program related investment (PRI): An investment to achieve a charitable objective over a financial return (sometimes called an impact-first investment). A PRI can count towards the 5% spending requirement for private foundations, and does not have to be a prudent investment.

Example: A foundation that supports affordable housing may use a PRI to purchase a building and convert it into affordable housing units.

Mission-related investment (MRI): A market-rate investment used to support the mission of the foundation. An MRI is not charitable activity and must be a prudent investment.

Example: The same foundation invests a portion of their portfolio in a publicly traded company that provides affordable housing in expensive areas of the country.

Did you find this answer helpful?

CapShift empowers advisors who work with us to deliver impact investing to their clients — every step from navigating client conversations to investment diligence.