As temperatures and ocean levels rise and the effects of climate change become more and more palpable, investors are increasingly interested in climate and environmental impact investing opportunities.

Governments, nonprofits, corporations, funds, and startups are all developing solutions to help tackle food insecurity, help prevent climate-related disasters, accelerate decarbonization efforts, and mitigate the negative impacts of climate change. CapShift is regularly working to expand coverage and sourcing opportunities on the topic of climate and environment to help you meet this client demand and help keep on top of new developments.

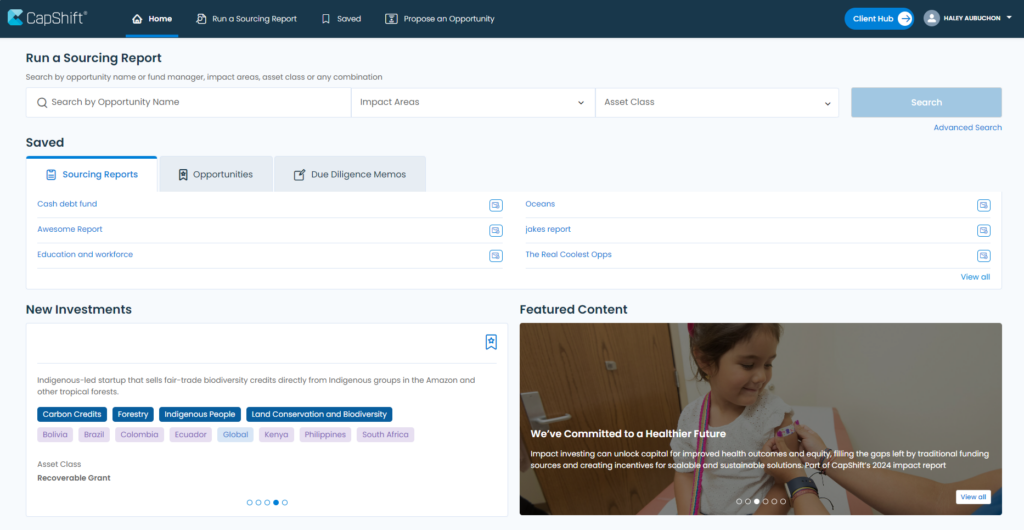

In the Research Engine, CapShift’s digital tool for investment professionals to conduct curated discovery of private impact investments, you’ll find more than 650 impact investing opportunities focused on climate, which represent over $101.2 billon in total offering size, and more than 80 due diligence memos that focus on climate or integrate environmental efforts in their strategies.1 This includes funds and direct investments in cash, private credit, private equity, venture capital, real assets, and recoverable grant products.

CapShift’s environmental category covers six key areas:

- Clean Technology & Infrastructure: Driving innovation to combat and reverse the effects of climate change.

- Food & Agriculture: Promoting regenerative agriculture and sustainable food systems.

- Energy: Expanding access to reliable, sustainable, and clean energy for all.

- Land Conservation and Biodiversity: Safeguarding natural resources and biodiversity through responsible practices.

- Water: Enhancing freshwater management for people and ecosystems.

- Oceans and Marine Life: Promoting restorative practices and sustainability for marine ecosystems.

One of CapShift’s strengths is its robust qualification and due diligence process. Our team vets investment opportunities across multiple sectors so our clients don’t have to. We carefully assess the impact thesis, alignment with the United Nations Sustainable Development Goals, impact sectors and categories, and assign an attractiveness score to each opportunity in our Research Engine.

Some examples of recently added opportunities in our Research Engine include:

- Early-stage company that repurposes end-of-life solar panels into structural building materials

- Women-led venture fund investing in innovations critical to helping drive the transition to a green economy, including Industrial and small and medium enterprise decarbonization, circularity, energy transition, built environment, and green chemistry and alternative materials

- Growth stage climate-focused venture capital fund investing in Series B/C tech companies that operate in decarbonization and energy efficiency sectors

- Early-stage company building accessible, real-time water monitoring solutions that use sensors and advanced software for flood management, coastal resilience, and aquaculture

- Women-led venture fund investing in early-stage companies focused on mitigating methane and super pollutants through agriculture, energy and mobility innovations

- Debt fund that aims to support the transformation of the food system into one that is regenerative, healthy, and resilient by supporting small businesses

Some investors choose to prioritize opportunities that maximize social or environmental outcomes and others decide to balance financial returns with impact goals. The Research Engine caters to both approaches, offering opportunities across the risk and return spectrum. Whether your clients seek opportunities in venture CleanTech or are interested in forestry and land conservation in emerging markets, the Research Engine provides the flexibility to align with diverse objectives.

As the climate crisis intensifies, policy shifts at both the national and international levels are creating new opportunities and challenges for impact investors. CapShift’s platform remains agile in identifying trends such as innovative carbon and greenhouse gases mitigation strategies, renewable energy incentives, sustainable agriculture practices, and technology developments that promote climate resiliency and adaptation. Staying ahead of these trends allows CapShift to see a dynamic selection of investment opportunities that align with emerging regulations and help capitalize on evolving market conditions.

CapShift’s Research Engine is ready to provide you with the tools you need to help you stay at the forefront of the climate investment landscape.

Please get in touch with us if you are interested in scheduling a demo to explore how the Research Engine can better enhance your practice.

If you are a fund manager, entrepreneur, or nonprofit leader interested in joining our database, please fill out this form to get started.

1 CapShift internal data.