2022 CapShift Impact Report

Amplifying impact

Around the globe, there are thousands of organizations developing solutions to some of our biggest social and environmental problems. Yet, scaling these solutions to bring them to the people and places where these innovations are most needed requires capital.

CapShift partners with families, financial advisors, and donor advised fund (DAF) providers to shift their capital into mission-driven funds and social enterprises. There are a few things we’ve noticed while doing this work.

Since our founding over three years ago, CapShift has

Shifted $169 million

into catalytic, mission driven public and private funds and nonprofit organizations

Funded 60

public, private, and nonprofit impact funds and enterprises working to tackle entrenched problems through our network

Empowered 100+

charitable account owners to shift capital into impact opportunities driving change for people and the planet

The top five impact themes supported by CapShift’s clients included

31%

Financial Services

29%

Climate Solutions

13%

Housing

8%

Healthcare

5%

Microfinance

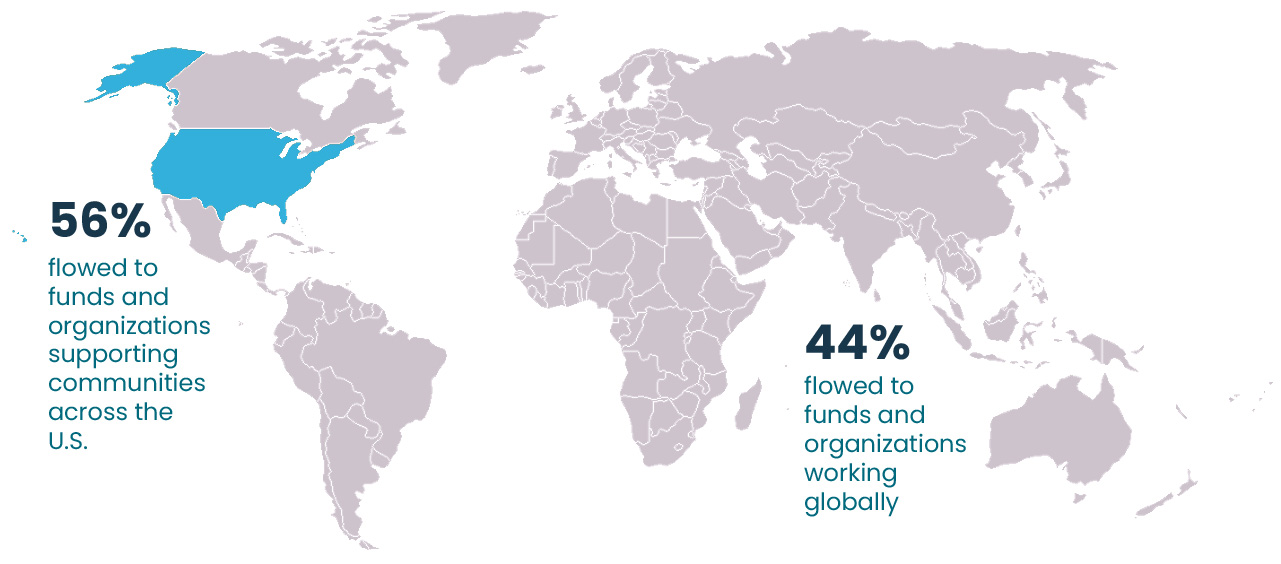

Geographies supported by private investments and recoverable grant allocations

Organizations addressing 15 of 17 of the U.N. Sustainable Development Goals received funding

Within each of these numbers are hundreds of stories of impact. Here are just a few.

Endnotes and disclosures

Unless otherwise noted below, all data contained within this report is sourced by CapShift from 1/1/2019 through 6/30/22.

Using dollars for change – Seven key insights into impact investing for 2022 and beyond – Fidelity Charitable

ESG by the Numbers: Sustainable investing Set Records in 2021 – Bloomberg

$98 million in private investments represented by 45% from private investments catalyzed through CapShift’s platform and 55% million catalyzed through partners.

Impact sector data represents the amount of money moved directly into impact focused private and recoverable grant opportunities from inception to June 30, 2022. Impact sectors and geography as assigned by CapShift. Excludes all public investments, private investments and recoverable grants supported indirectly. Excludes opportunities with multiple underlying sectors (e.g., multi-impact sector funds).

Geography and Impact Sector Data represents the amount of money moved directly into impact focused private and recoverable grant opportunities from 1/1/19 to 6/30/22. Impact sector and geography

categorization as assigned by CapShift. Excludes all public investments and private investments supported indirectly. Self-reported or CapShift ascribed classification refers to primary impact sector only and opportunities may operate across multiple impact sectors. UN SDG data: Each opportunity corresponds to its top 3 SDGs either self-reported or CapShift ascribed based on review and comparable opportunities. Excludes all public investments, private investments supported indirectly.

Data is self-reported by select investment and recoverable grant recipients. 3.3 billion trees planted and 466,000 tons of materials in circulation data is since inception through end of the 2021 fiscal year, All other data is fiscal year ending either12/31/21 or 6/30/21.

This report does not constitute an offer to sell or a solicitation of an offer to purchase any security. Any such offer or solicitation would only be made pursuant to an offering memorandum or prospectus. All investments entail a high degree of risk and no assurance can be given that the investment objective will be achieved or that investors will receive a return of their capital. Any investment opportunities highlighted in this presentation are presented for illustrative purposes only. Opportunities may not be suitable for all investors due to differences in risk tolerance, investor status, and investment time horizons, amongst other factors. Additionally, investments may not achieve stated social, environmental, or similar objectives.

This report highlights the self-reported impact of CapShift LLC and CapShift Advisors, the two entities are referred to as CapShift throughout the report. CapShift gathered self-reported data from a select group of funds, nonprofits and social enterprises that received investment or grant capital directly or indirectly from work CapShift performed or influenced. The data CapShift is reporting has not been audited or reviewed by a third-party.

Advisory services are provided by CapShift Advisors LLC, an SEC registered investment advisor. Investments in securities are not FDIC insured, are not bank guaranteed and may lose value. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives and CapShift Advisors LLC’s charges and expenses. CapShift Advisors LLC’s advisory services are designed to assist clients in achieving discrete financial goals. They are not intended to provide financial planning with respect to every aspect of a client’s financial situation, they do not incorporate investments that clients hold elsewhere, and they do not provide tax advice. Past performance does not guarantee future results, and the likelihood of investment outcomes are hypothetical in nature. Nothing in this presentation constitutes an offer, solicitation of an offer, or advice to buy or sell securities in jurisdictions where CapShift Advisors LLC is not registered.